Amazon and Industrial Real Estate

Industrial REITs have underperformed sharply since Amazon’s Q1 call, when they talked about overcapacity in their delivery network. Does this reaction make sense?

I don’t think it does, but let’s start by trying to lay out the strongest possible version of this short thesis. Then I’ll explain why I still disagree, and talk about what else might happen at Amazon that would be incremental.

The best version of the bear case

As with any thematic trade that rockets around the market, this one seems to have accrued some mistaken assumptions — about things like Amazon’s share of industrial REIT tenancy (~5%), or when they began this slowdown (more than a year ago), or how much of their space they’re actually giving up… one good place to brush up on this stuff is PLD’s research site, which includes two recent reports in direct response to the current selloff. But I won’t get into more of it here. Again, I want to take on the best version of this bear case, even if I have to write it myself:

E-commerce isn’t everything, but it’s the marginal demand driver that has pushed warehouse demand into overdrive over the past decade. And Amazon isn’t everything, but they were a hugely outsized contributor to e-comm leasing, and they’re still the market leader that others are trying to catch — so a change in their tone could ripple across a lot of other demand.

Anyway, their call was just an early warning of a larger problem that became obvious during retailer earnings: bloated inventory across the board, just as consumer spending rotates back from goods to services. As retailers clear that overstock, they’ll need less space to store it, and they’ll be more cautious about inventory in the near future.

On top of that, we have a pullback in e-commerce penetration as stores reopen, and it takes less warehouse space to keep stores in stock than it does to service e-commerce. On top of that, supply chains are loosening up again, so there’s less need for extra “safety stock.” On top of that, we may be heading into a recession.

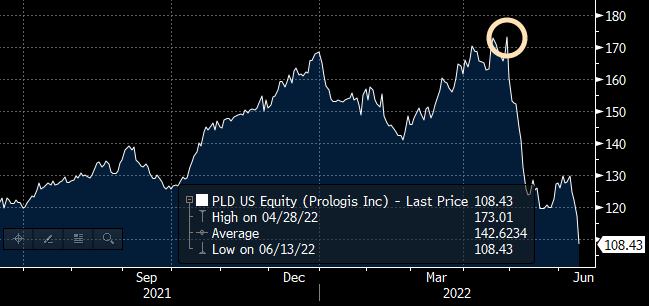

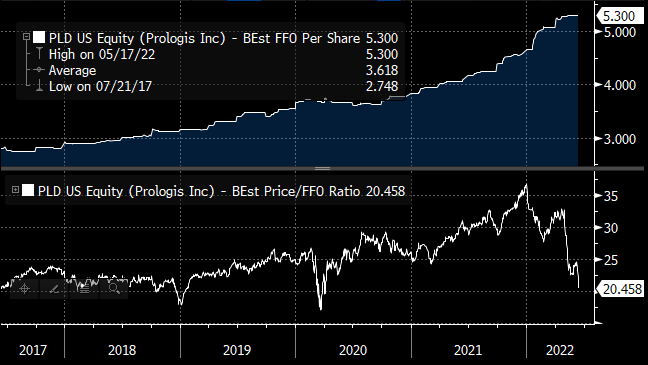

So this is a perfect setup for industrial REITs to correct even further. They’re still trading at an average multiple in the low 20s — and at an average implied cap rate in the mid-4s, with the 10-year now well above 3%. They’re still above pre-Covid levels, in contrast to some other pandemic winners like Peloton or Netflix that have given it all back and more.

As with those stocks, it’s clear that demand for their product was pulled forward and is now slowing down. And on the supply side, new warehouse development has been booming. So even if it takes a little longer for all this to filter into REIT numbers, why shouldn’t the market be re-rating them today?

Why it’s still wrong

Three quick points to start. First, the extra “safety stock” in retail was often more of an aspiration than a reality, and many retailers were still just trying to catch up to current demand.

Second, it’s far from clear that supply chains are better across the board, as opposed to a continued game of whack-a-mole — e.g. container rates are coming down, but now we have more lockdowns in China, and a potential port strike in LA.

Third, the current pullback in e-commerce penetration is not a surprise. It’s exactly what most public retailers were predicting — a retreat from the pandemic peak, but still well ahead of 2019.

If these three points are hard to see in the current news flow, that’s partly a matter of the mix effects between different categories. Some of the products where demand surged during the pandemic — like home electronics — were the ones that already had higher online penetration and AMZN market share. Others involved more specialized supply chains that have their own dynamics, like bulk delivery (furniture) or cold storage (groceries).

And yes, some individual retailers have been overly optimistic about their own categories, and they’ve been caught off guard by the speed of this rotation. I would expect a lot more of that ahead, and I’m definitely not calling a bottom in retailer stocks. But for our purposes here, the real surprise would have been online penetration within any given category trending below 2019 levels — or at least below the pre-Covid trendline. And this is not at all what we’re seeing.

We could get sidetracked here into some more detailed discussions about the current retail environment, but it’s all a step or two removed from the real question at hand — because hopefully we can agree that no one is signing warehouse leases based on their real-time inventory or sales. What you’re really betting on with the REITs is something like the supply and demand for warehouse space over the next 3-5 years, right?

So is there a good reason to believe that this multi-year supply outlook has increased recently? Or that the demand outlook has declined?

The overbuilding argument makes sense intuitively, but not from the bottom up. If your mental model of the real estate industry is that they want to overbuild with other people’s money in every cycle, you’re correct. The question is whether they can.

And for various reasons, it was already getting tougher even before the pandemic. But what’s happened to development costs and timelines over the past two years is unprecedented. This is Prologis CEO Hamid Moghadam on their acquisition of Duke Realty, announced yesterday:

I don’t know where the private market is today. But I can tell you one thing, that these assets are significantly below replacement cost — because the very things that are driving up interest rates, and therefore having an adverse effect on valuations and cap rates, are driving up replacement costs. In fact, I would venture [that] replacement cost is going up faster in the last year or two than ever in my career, and I’ve been doing this for 40 years…

And so that requires higher rents. And if those rents don’t materialize, then presumably rational people will not be building those buildings… and we’re dealing with a market that’s 4% vacant… putting cap rates aside, we’ve really seen no letup in demand and trajectory of rents in most markets. Maybe that will come later. But we haven’t seen it yet, because it’s such a tight market and it’s so difficult to bring on supply…

I would add that the part about replacement cost applies to almost every property type, not just industrial. So even if we do wind up with some excess warehouses that were overbuilt with Amazon in mind — and we probably will! — there may be an offset in terms of non-industrial higher uses for more infill locations.

Now, if your problem is on the demand side, it’s a more complicated discussion. But to believe in a real multi-year demand shortfall from here — not just a temporary second half slowdown, which is more than priced in — I think you have to believe at least one of these two things:

1) That a material amount of non-Amazon leasing demand was pulled forward over the past two years. I’m sure a little bit was. But over hundreds of other retailer earnings calls in the past few quarters, I’ve heard very little of what Amazon is describing.

As I just wrote about developers, it’s not that there weren’t more retailers that wanted to take too much space. But they couldn’t. In terms of execution and speed, AMZN was really an order of magnitude ahead of everyone else.

2) That growth in e-commerce penetration will slow down. In other words, the trend from this new 2022 baseline will be lower than it would have been without the pandemic, or at least lower than it looked a year ago. Is there any good reason to expect that?

This is where it’s important to distinguish between demand for a product and adoption of a new channel or technology, which can’t be “pulled forward” in quite the same way. If you bought a new tennis racket in 2021, you may not buy one in 2022. But think about the marginal consumer who first shopped online during shutdowns. What would it mean for that online penetration to have been “pulled forward”?

One thing it might mean is that ex-pandemic, some of these folks would have placed their first online order in 2023; now they’re already in the numerator. But realistically, more of them were likely older customers who would never have adopted online ordering at all. Now that they’ve had to do it for category X, they might be more likely to try it in categories Y and Z. In other words, there’s at least one plausible case for the trend to be higher from this new baseline.

Again, we could go down some interesting rabbit holes there, but let’s keep going. What about the charts and valuation metrics?

All I would say about that is to play fair, and not look for the same downside on lower-beta stocks that saw less upside. Remember that some of these other non-REIT pandemic stocks were 5x+ in 2020, and some of them never turned profitable (or only briefly) even on their own highly adjusted terms.

Contrast that with the industrial REITs, where you’re now paying well below a pre-Covid multiple on much higher earnings, with high payout ratios…

…and their in-place rents are so far below market that even the worst-case scenarios for tenant demand would not lead to an actual decline in earnings for years to come. And in that scenario they could likely still keep going private at hefty premiums.

So if you’re betting against these stocks at current levels, and you don’t have a deep and differentiated view on the 3-5 year supply and demand drivers above… what more are you really playing for?

But something weird is going on with Amazon, right?

Right. Well, I think so. I’m not an Amazon analyst, and there are some parts of this story that I won’t speculate about. But it does feel like we’re approaching more of an inflection in their logistics strategy than what I’ve heard about from anyone in this current debate.

The REITs (and others) have suggested that a lot of this current Amazon subleasing will be for short terms, that they have more overcapacity in warehouse labor than space, and playing up the space contraction may help them with labor negotiations. I agree with all that as far as it goes, and it lines up pretty well with what Amazon has said themselves.

But it raises the further question of what they’re actually aiming for on the labor front, and what their broader post-Covid logistics strategy will look like. So when I say “inflection,” I’m imagining something on the scale of their decision almost a decade ago to start collecting sales taxes in every state, which really opened the floodgates for much of their subsequent expansion.

Obviously I don’t expect them to try to reverse that decision, but there could be some equally significant pivot ahead.

What kind of pivot? For the kind I’m most concerned about, let’s go back to that now-infamous call on April 28th:

Q: Now that you’re getting SKU selection, in some cases, back to where it was pre-pandemic — what are you seeing from a demand or an elasticity perspective [around] one day / same day? Is it really leading to incremental sales?

A: Yes, we’re approaching the service levels that we had pre-pandemic, and that’s a positive sign. But this doesn’t turn on a dime. As a consumer, I’ve noticed it myself. I see more things in stock, and it opens up the consideration set for things that I may have had to run to the store to get in a short period of time.

And as you see more and more that you [can] trust it, and you continue to order, and you then go to Amazon first… it has to be built over time. It doesn’t take years, it hopefully takes weeks and months. But we’re hopeful and expectant that that will add good elasticity, the same elasticities that we started to see pre-pandemic.

This is something I’ve been focused on since well before the pandemic. From one of my subscriber notes in 2019:

Consumers did not rise up fifteen years ago and demand two-day shipping. Prime was a deliberate strategy for customer acquisition and retention, one that turned the weakness of Amazon’s platform into a strength as they pushed beyond books and music: they may not have had the name brand item you wanted, but whatever they did have, they could get to you faster and with less hassle.

This strategy has been so successful that they’ve forced everyone else to compete on their terms, and it’s driven an entire ecosystem of online review sites and subscription business models that goes far beyond Amazon and their top competitors. But like all great marketing, it was creating a consumer preference as much as catering to one: in this case, that when you get something is almost as important as what you get.

In other words, we need to start arguing less about e-commerce volumes and thinking more about speed. We’d all rather have our orders sooner than later, but that demand is not inelastic. As rapid delivery becomes more expensive, other customer acquisition / retention tools will become more attractive, and one way or another, more of the costs of rapid shipping will be passed through in a way that consumers can accept or reject on an order-by-order basis. And then we’ll learn what it’s really worth to them.

There are a hundred little ways that this is already happening, and not just at Amazon. But no one has more data on these relevant elasticities than they do, and we’ve never had more of a natural experiment to test them than we just did with Covid. So if anything, they’re much better positioned now to make a strategic pivot than they were when they launched Prime.

Does this mean I’m a long-term bear on warehouse demand after all? Not necessarily. For one thing, the fact that Amazon started this delivery-speed arms race does not necessarily mean they’d be able to stop it. And some of the other strategies they might pivot to could also be fairly warehouse-intensive. But I do think we should be talking about these things more on the real estate side, and not just repeating the truism that consumers want everything even faster. That’s not the only axis on which retailers compete.

Back to the main question we started with: I am hardly a reflexive REIT defender, as my prior public notes make clear, but I just can’t get this latest REIT short theme to make sense. If you think there’s an element that I’m missing above, I’m curious to hear it. But for anyone who’s just looking for a derivative bet on this current Amazon news flow, and can’t find a better option than this little cluster of high growth REITs that get taken out every month — I’d say keep looking.